It’s good to talk. And it’s good to talk about money.

Money is not always a subject that people feel comfortable talking about, and as a nation we’re generally quite humble or reserved when the topic comes up.

We often go on holidays with friends and it’s quite a challenge from the initial planning phase to even while we’re away because we all know people have different budgets but many of us find it hard to say ‘we can’t afford that’ or ‘I’m not prepared to pay that much for that’.

In this country you have to know people well before they will talk openly about money. I lived in Australia for three years and it was quite different there!

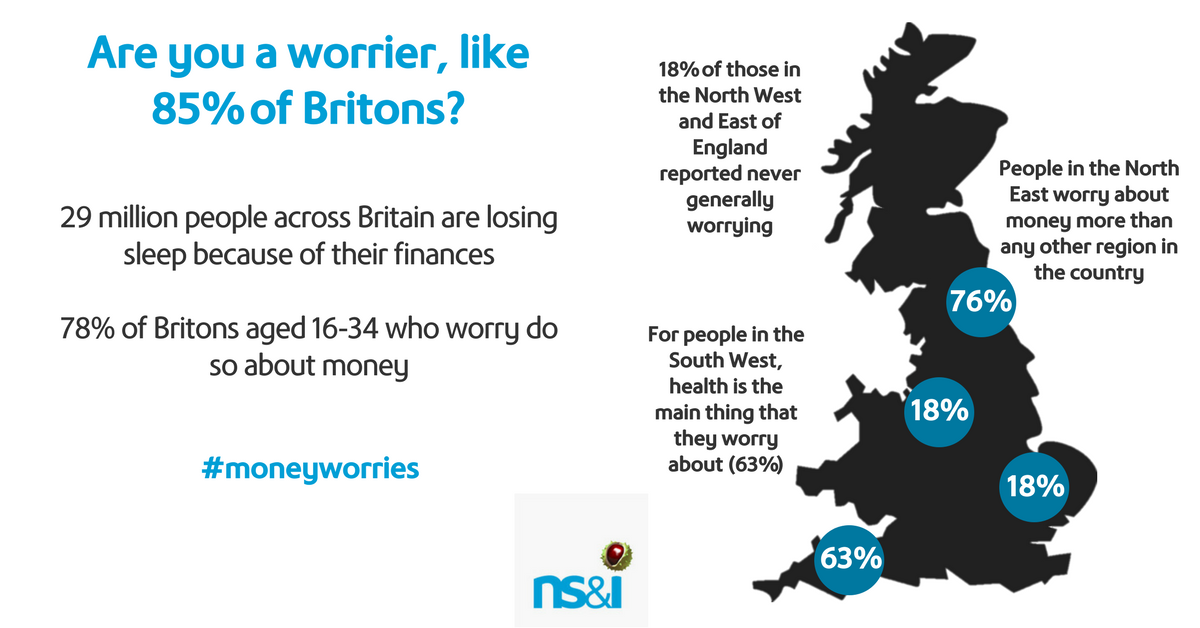

Earlier this year, we produced some research about people’s concerns about personal finance and the results were quite shocking.

We found that over 29 million Britons have money worries.

But, added to that, a lot of people don’t talk about their finances and any associated worries, often because they don’t know who to talk to about their issues, or how to even start that conversation.

Money and health – intrinsically linked

In our efforts to inspire a stronger savings culture in the UK, we’re committed to finding new and innovative ways to support initiatives that broaden people’s understanding of finances.

Just last month, insurance company Aegon found that four million sick days, worth an estimated £1.6 billion to the UK economy, were lost because workers had significant financial worries and associated stresses.

Having even a small amount of savings can make a huge difference. When I first had a mortgage interest rates almost doubled and I couldn’t cover both that and the cost of getting to work each day, never mind the rest.

I survived because I was fortunate to have some savings, but even then I knew they wouldn’t last forever and I worried about how I would cope in the future. Friends who didn’t have savings often struggled – increasingly dependent on debt which made life even less affordable. Stress often leads to sleepless nights and then to illness.

Education supported by action – how we’re aiming to do the right thing

We’re supporting schools and financial education through the National Numeracy Trust, with five schools local to our staff having received special packs to support numerical literacy in primary education.

And we’re making it easier for people to save and build up their pots for whatever goals they have in mind through our simple, but effective, products.

Through Direct Saver, our Direct and Junior ISAs, which all require a minimum of just £1 deposit, and the changes to initial deposit limits for Premium Bonds down from £100 to just £25, we’re making it easier for people to access simple savings for small, but regular, investments.

It all adds up.

We’re also the delivery partner for the Government’s flagship Help to Save scheme, giving people receiving Universal Credit and Working Tax Credit support to build up their savings – a terrific initiative that I’m incredibly proud to be a part of.

#TalkMoney: Quick ways to improve your finances and capability

Our staff charity, The Share Foundation, supports children in care to understand and manage their finances. They have recently launched a scheme to help incentivise some core learning modules – one of which is managing their money, an eight-session course coordinated by the Open University.

It’s free for everyone to take, so if you want to improve your own financial literacy or understand ways in which we can have better conversations with customers and colleagues about money, I’d urge you all to check out the resources online.

And as we found last month, around seven million people in Britain think they may have lost track of a financial product.

Registering and completing the My Lost Account online form to check if you’ve got any forgotten assets only takes a few minutes and could reveal a tidy sum, which could cover some of the costs for Christmas or, if reinvested, could kick off a new savings habit in the New Year.