Image library

If you are looking for image assets including logos, marketing images and photos of senior staff, please explore our Image library or request assets from our Media team.

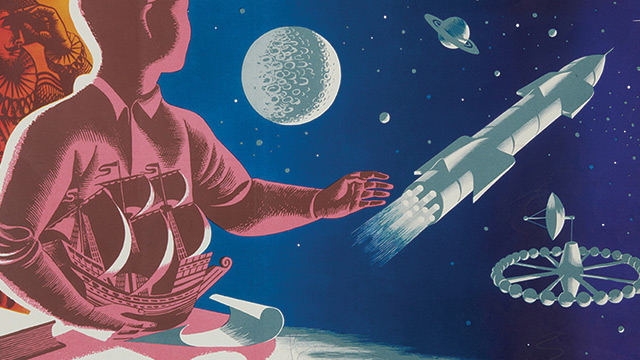

Our heritage archive

Contact the media team for posters and adverts from throughout our history.

Historical interactive timeline

See the story of NS&I from 1861 to present day

Our performance

In 2024-25

Digital-first

Amount of key service levels achieved versus total contractual service levels, where service credits apply, across all GPS clients

Administration cost per £100 of funds held by NS&I

As at March 2025, more than half a million Help to Save accounts had been opened

In 2025-26

In Q3 2025-26, NS&I delivered £5.9 billion of Net Financing, against a whole year target for 2025-26 of £13.0 billion (+/- £4 billion), excluding Green Savings Bonds.