-

Our story

Our story

-

Foundation

1807 - 1914

Foundation

1807 - 1914

-

Wartime

1914 - 1945

Wartime

1914 - 1945

-

Peacetime

1945 - 1962

Peacetime

1945 - 1962

-

Computer Age

1963 - 1995

Computer Age

1963 - 1995

-

Internet Age

1995 - Present

Internet Age

1995 - Present

Our story

NS&I has a long and varied history over more than 150 years. In good times and bad, we're always looking for new and innovative ways to help the nation save.

Foundation

The industrial revolution

As the Industrial Revolution progresses through the 19th century, there's a growing need for industrial workers to put money away ‘for a rainy day’. Special institutions spring up to promote thrift and encourage ordinary citizens to save.

First stirrings

Samuel Whitbread MP proposes a Savings Bank operated by the Post Office on behalf of the Government. Money deposited would be held in a ‘Poors Fund’ and invested in Government stock. Far from happy with this idea, the big banks use their power to create sufficient opposition and the Bill is defeated.

Victorian era

Great Britain and its Empire are growing and expanding. This, combined with the Industrial Revolution, widens the gap between rich and poor. Many Britons suffer poverty with little hope for the future.

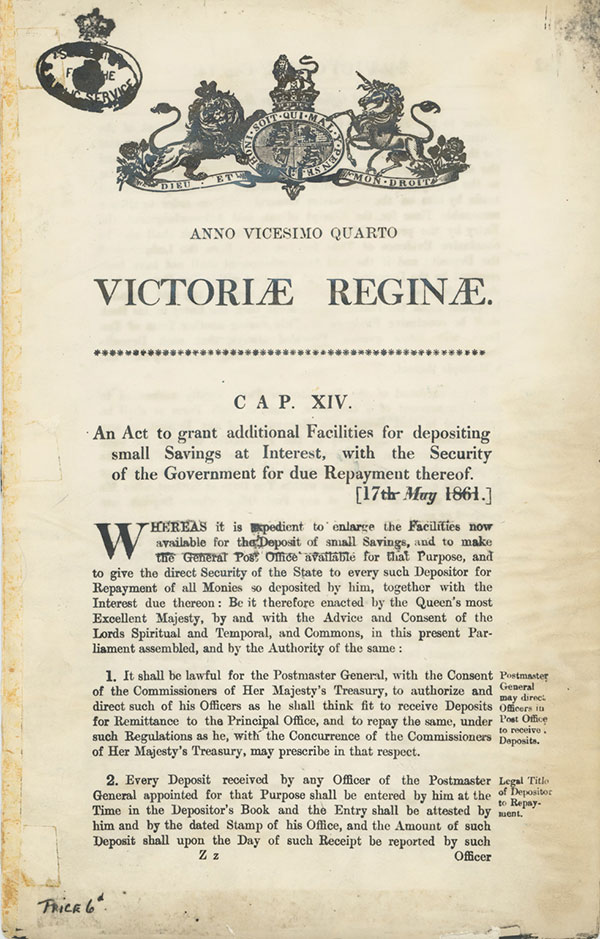

National Savings Founded

William Gladstone, Chancellor of the Exchequer, launches the Post Office Savings Bank ‘within an hour’s walk of every working man’s fireside’. The first available product is the Ordinary Savings Account.

The National Debt Act

The National Debt Act enables people with Post Offices and Trustee Savings Banks savings accounts to extend their savings by investing in Government Stock funds. Dividends are payable only by credit to the savings accounts concerned.

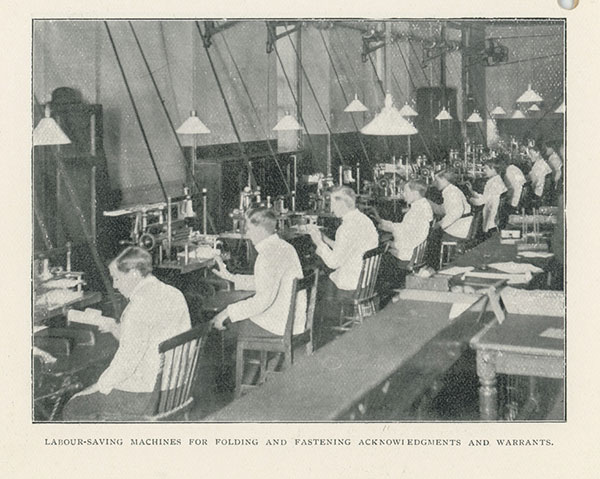

Overcoming sexism (slowly)

Sir John Tillbery, Post Office Secretary, radically suggests appointing ‘a few gentlewomen’ to work in the National Savings Bank. One, 23-year-old Constance Smith, sets out to show how women can do just as good a job as men. She’ll go on to become Superintendent of the Bank. Under her watch, the number of female employees grows from 35 in 1876 to 3000 by 1913!

Wartime

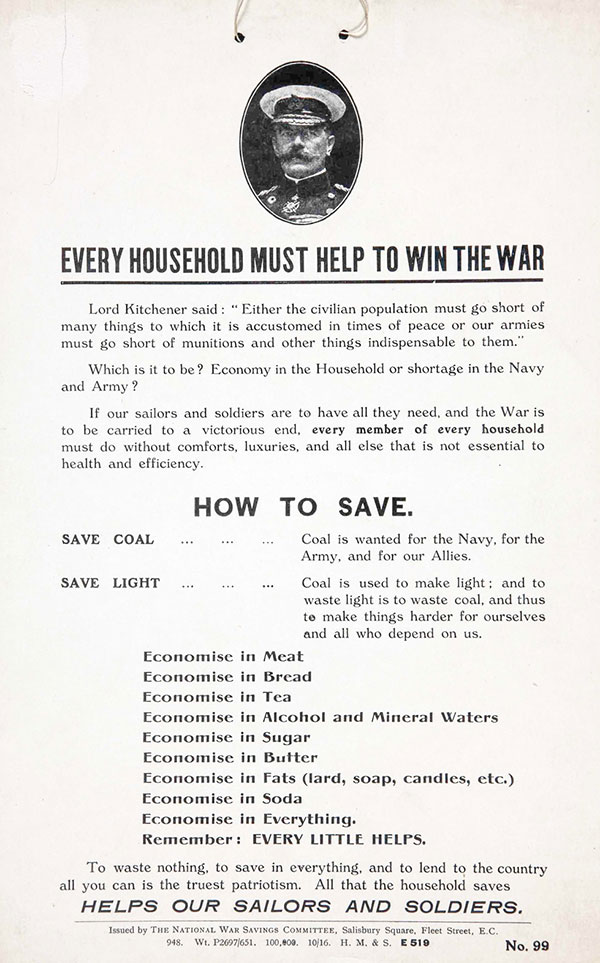

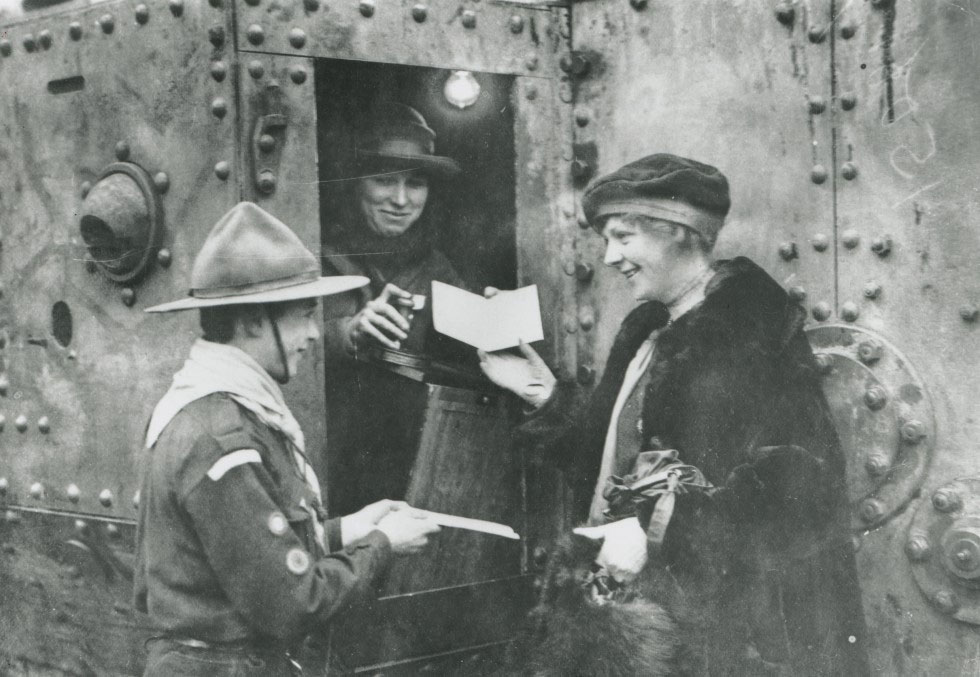

First World War

The First World War brings a sharp increase in the Government’s need to borrow money. Introduced in 1917, paying 5 per cent interest, National War Bonds form part of Government efforts to fund the ongoing cost of the war. Along with every sector of industry and society, the Savings Bank sees many employees lose their lives, from 18-year-old boy clerks to older, senior members of staff.

National War Savings Committee founded

National War Savings Committees are set up to encourage savings and thrift - organising savings in factories, housing estates, schools, shops and offices. Continuing well into peacetime, the Committees produce posters and exhibitions that help to make National Savings a truly successful institution.

Special Savings Stamps launched

New Special Stamps feature designs including Britannia and a Swastika - then only known as a Sanskrit symbol of good fortune.

WW1 Success

The amount raised during the 1st World War totals almost £433 million (the equivalent of nearly £24 billion, based on 2018 values). By the end of the War Bonds campaign (30th September 1917 to 31st March 1918), there are 1,686 War Savings movements and 40,065 War Savings associates.

On 12th March 1919 the Times newspaper said: “Among the new institutions to which the war has given rise, there has been none that has done more valuable work than the National War Savings Committee… But what was even more important fundamentally was the proportion of national economy and saving among the masses of our people.”

The Great Depression

The number of Savings Associations has shrunk from a high of 41,000 in 1919 to no more than 18,400 in 1923. The country has survived immediate post-war social and economic turmoil, including the General Strike of 1926. But the American financial crisis of 1929 rocks the world, followed by a global depression of trade and employment, leading to years of human suffering and desperate endeavours by British governments to regain prosperity.

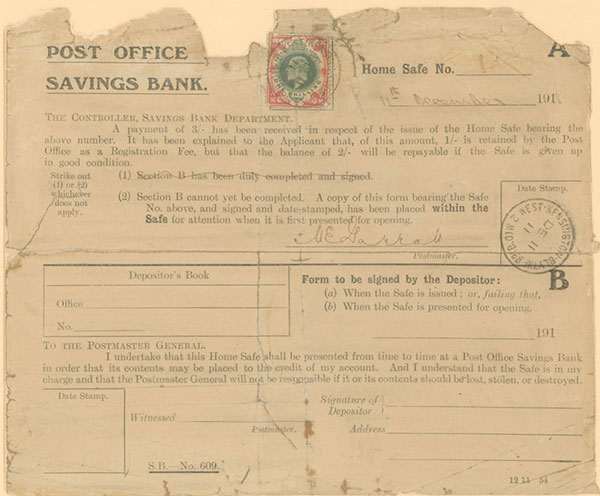

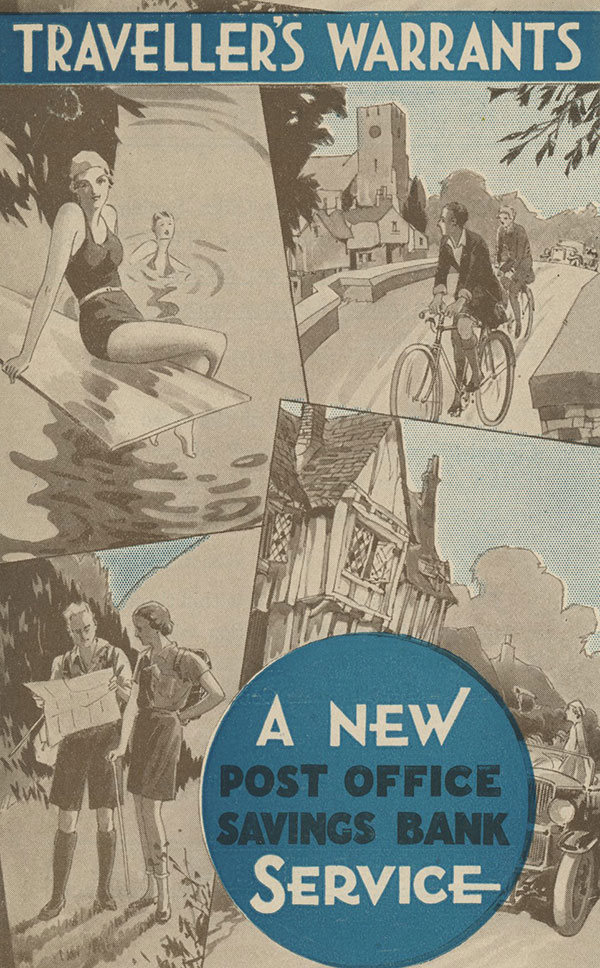

Traveller’s Warrants and Cruising Credit

Post-war realities have made Saving more than an idea of putting money away for a rainy day. The practice of saving money to spend on necessities, or even affordable luxuries, begins to take off. How about Cruising Credits? This enabled passengers on British cruise ships to take any sum from their Post Office Savings Bank account to use as on-board credit.

Second World War

The Second World War is the most widespread armed conflict in history, directly involving more than 100 million people from over 30 countries. In a state of ‘total war’, the major participants throw their entire economic, industrial, and scientific capabilities behind the war effort, erasing the distinction between civilian and military resources.

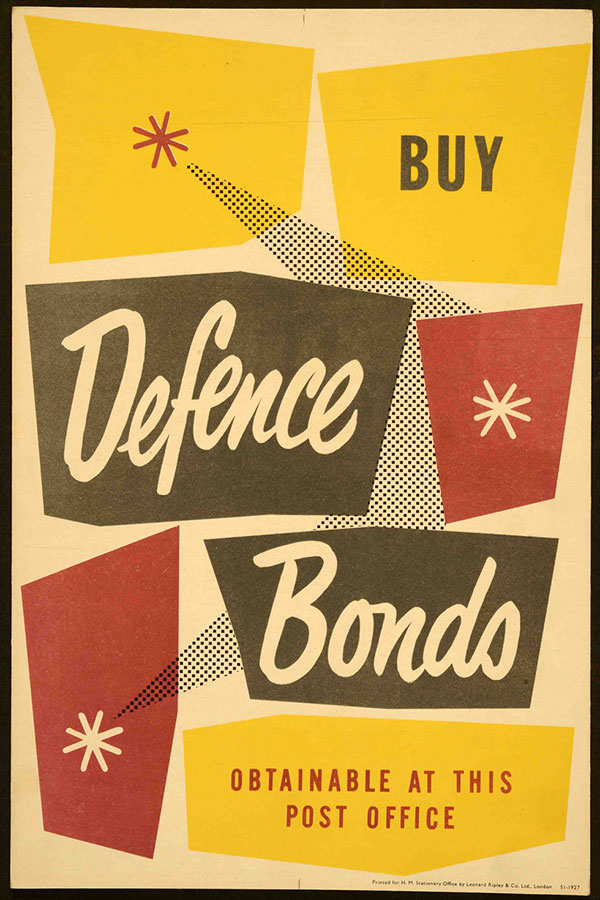

Lend to defend

Throughout the Second World War, the Savings Bank runs a nationwide campaign to fund the war effort. This ranges from small, community-based initiatives, to large campaigns in key locations in London. Between 1939 and 1946, Savings Bank deposits rise from £509 million to £1,982 million and the number of accounts more than double from 11 to 24 million.

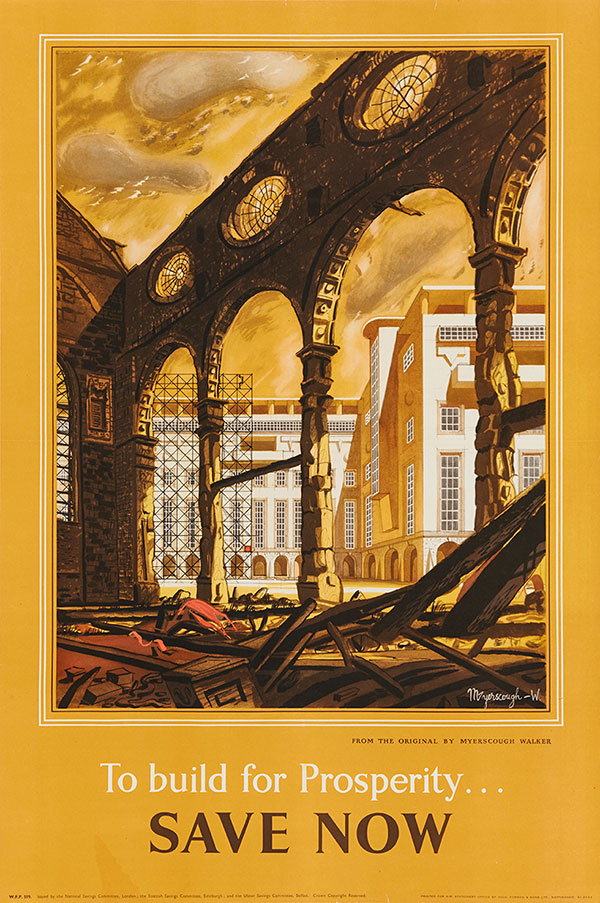

Blitzed

During the Blitz, London is systematically bombed by the Luftwaffe for 56 out of 57 consecutive days and nights. Many National Savings Staff suffer from the bombardment, but others help with the Home Guard, Fire Watching and First Aid. Some run a magazine called ‘Bank Notes’, aimed at Savings Bank men in uniform. Special arrangements provide saving accounts for service men from the allied forces; including Poles, Belgians, Canadians, Greeks, Czechoslovakians and Americans.

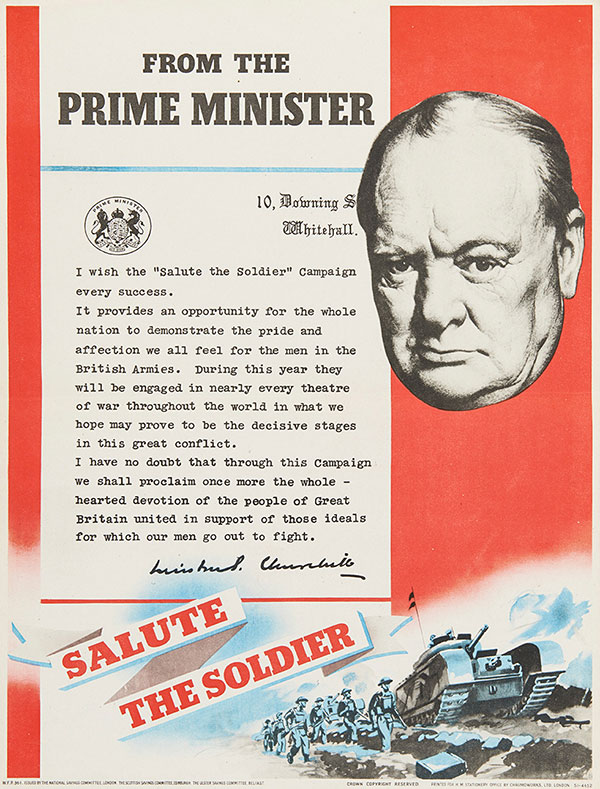

Savings Campaign Weeks

Savings groups are organised everywhere to adopt battleships, aircraft carriers, cruisers and destroyers - villages, towns and cities all raise money with patriotic enthusiasm. British national savings campaigns include Warship Weeks in 1941, Wings for Victory Weeks in 1943, and Salute the Soldier Weeks in 1944.

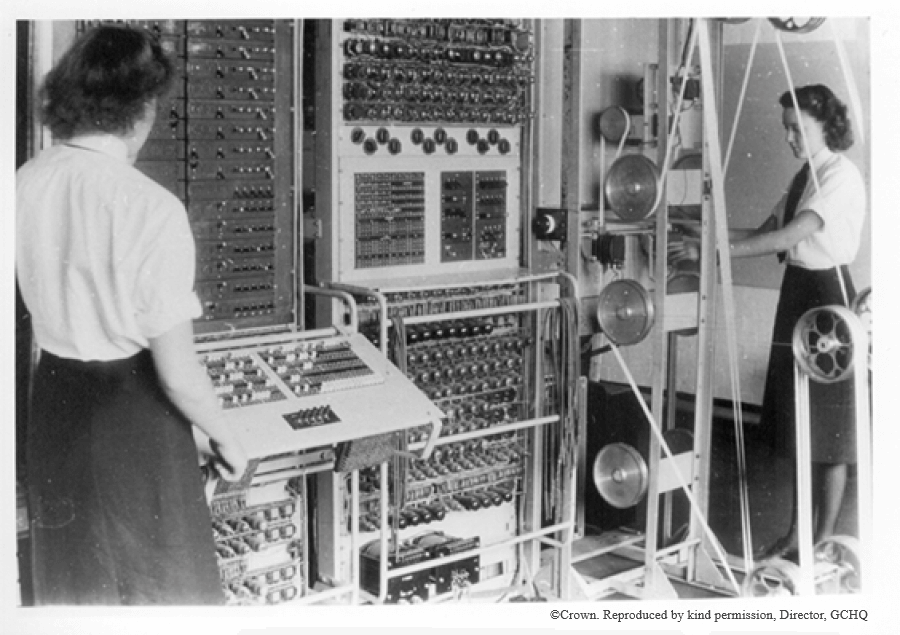

The First Digital Computer

To help read German coded radio messages during World War II, codebreakers at Bletchley Park create in secret the world's first programmable electronic digital computer, Colossus. After the war, their expertise contributes to the technology underlying Premium Bonds.

Peacetime

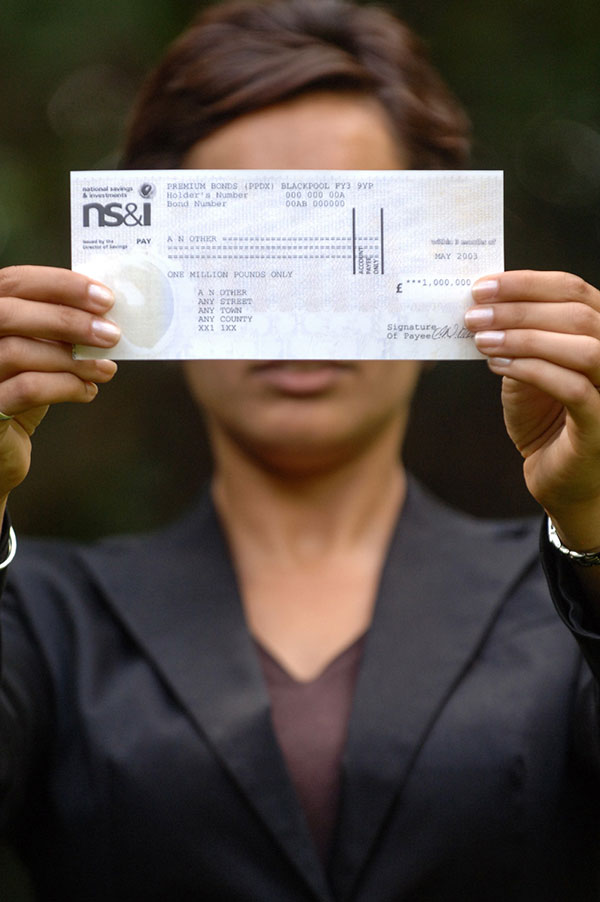

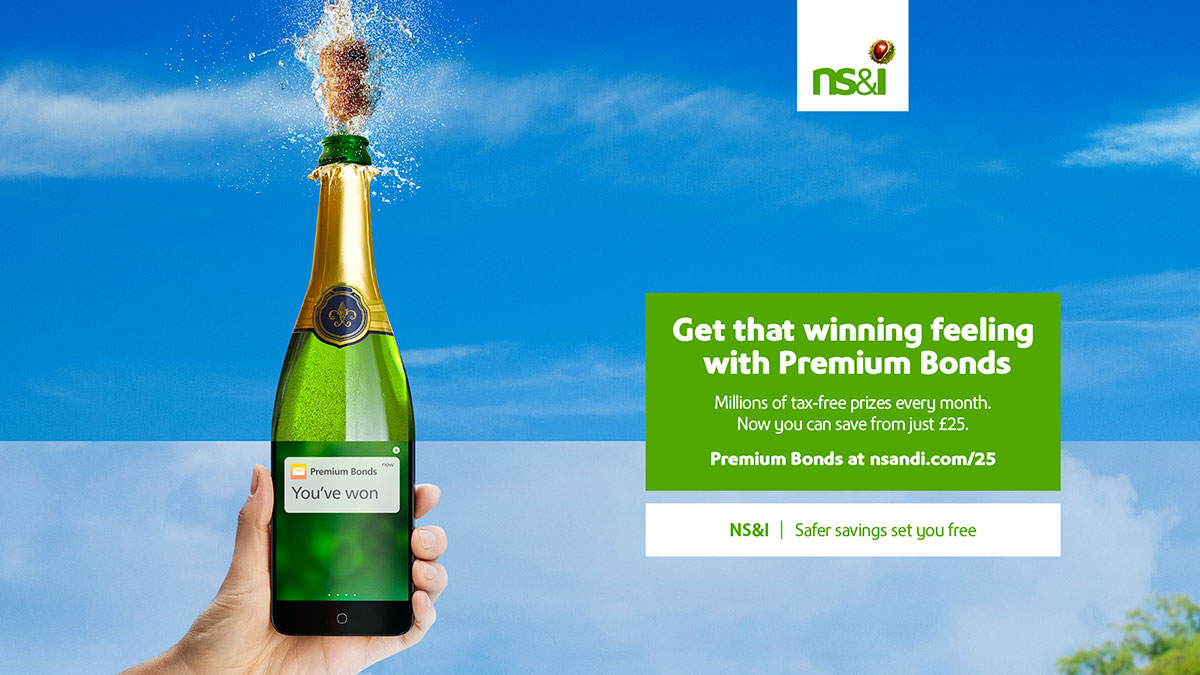

Introducing Premium Bonds

Premium Bonds are an idea dating back to the First World War. Now, from 1 November 1956, they’re actually on sale for the first time. Harold Wilson, Shadow Chancellor, calls Premium Bonds a ‘squalid raffle’. Church leaders warn it will lead the population to gambling. The British public buys £5 million worth on the first day (the equivalent of approximately £121 million, based on 2018 values)

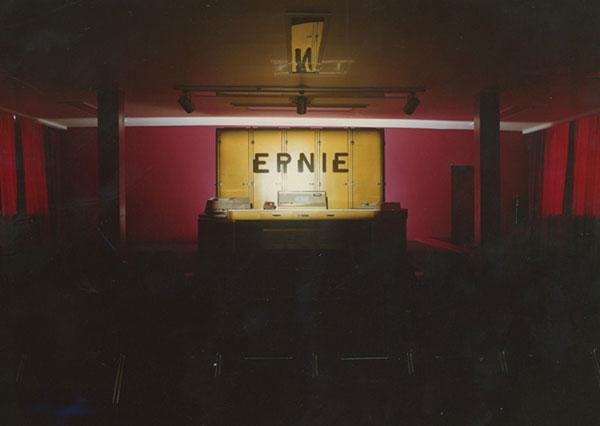

Introducing Ernie!

The Team behind the Second World War code breaker, Colossus, gets to build the machine that selects the winning Premium Bond numbers. Introducing ERNIE (Electronic Random Number Indicator Equipment) – he’ll generate bond numbers based on the signal noise created by neon tubes, and will take 10 days to complete a draw.

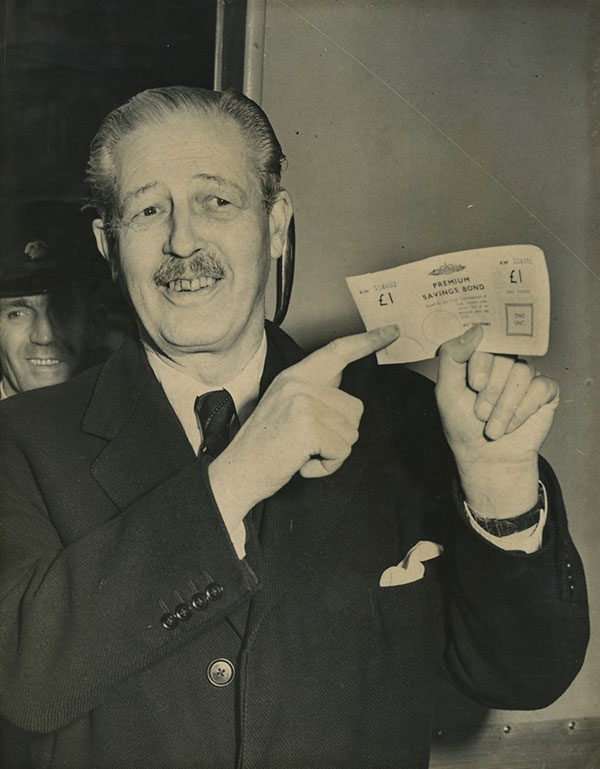

The First Draw

Lytham St. Anne’s, near Blackpool, Lancashire, England. 9.15am, 1 June 1957. Ernest Marples, Postmaster-General, flicks a switch. Sixteen minutes later, the first winning number is produced: Premium Bond 1KF341150, held by an investor in Cumbria. It should take 30 hours for ERNIE to complete his task, but the draw goes on until 3 June, because the engineers and staff must get some rest.

Computer Age

The Computer Age

The era of mainframe computers sees rapidly improving transistor technology. Massive, room-sized computers are expensive to buy and maintain, but they’re soon providing data calculation way faster and greater than anything human beings can do.

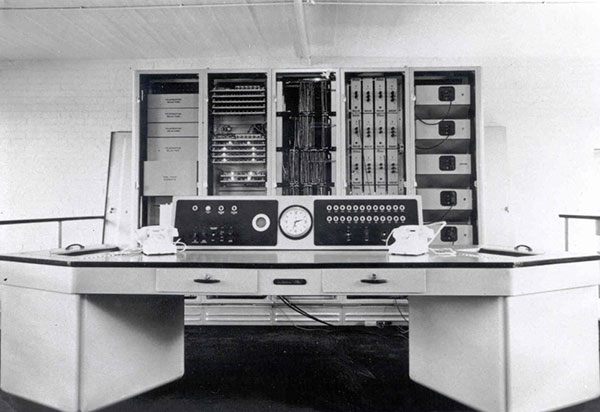

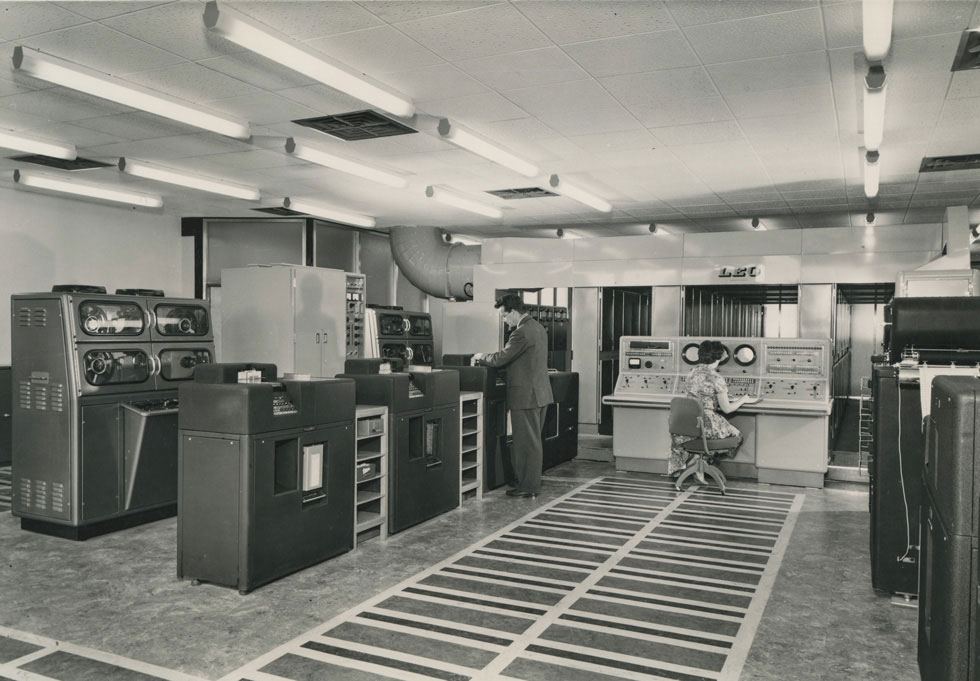

LEO 326

Employing about 9,000 people handling over 20 million accounts by the late 1950s, the Savings Bank has no choice but to modernise further. Computers can help. In 1962, National Savings invests in two LEO 326 Machines and ICT punchcard technology. By 1968, the first computer-based accounts are up and running.

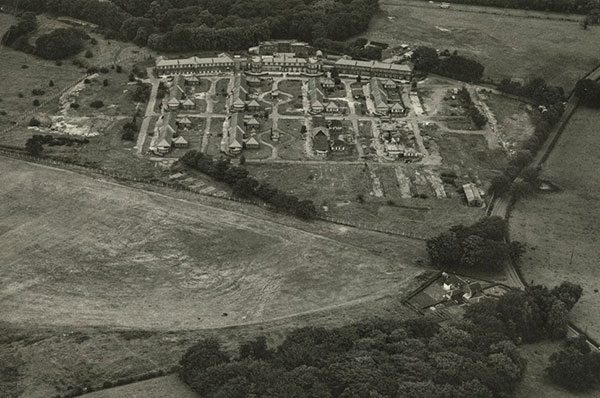

A New HQ in Glasgow

Moving? Again? The Fleming Report on the location of government offices does not specify where the Savings Bank should move. After a tender process, Cowglen, Glasgow is the right choice. With the latest punched card processing equipment, Glasgow is soon dealing with an increasing proportion of the work of the London Balancing Branch.

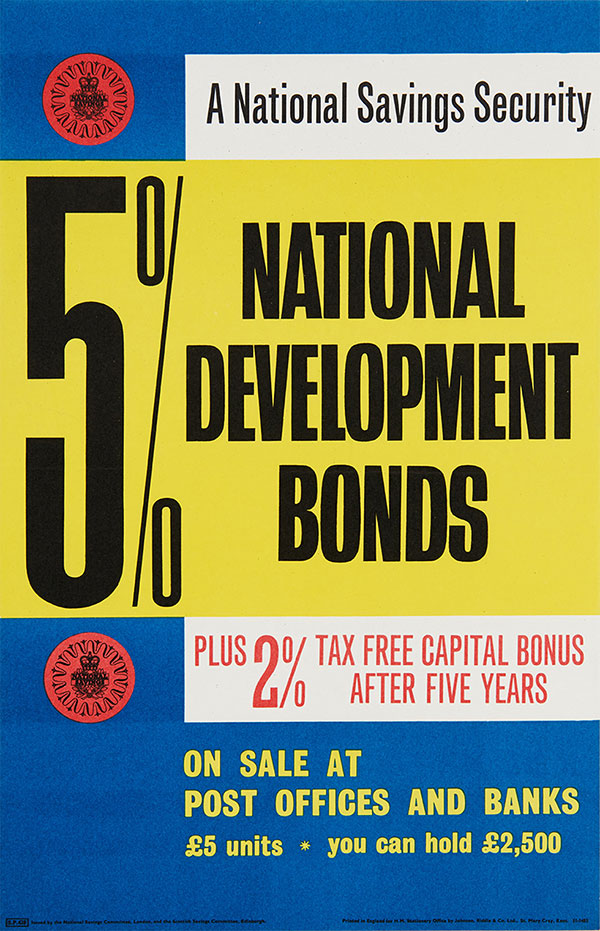

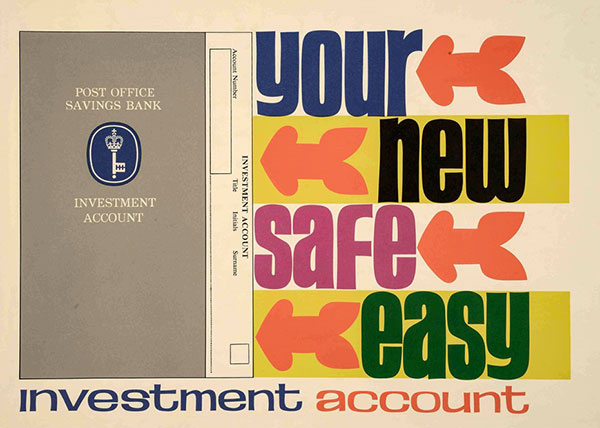

Investment account

After a period of successful preparation, the Savings Bank Investment Account opens for business on 20 June 1966. On the first day of business, 2,831 accounts are opened, with balances totalling £766,485. Within 6 months, there are 200,000 accounts and £70 million in savings.

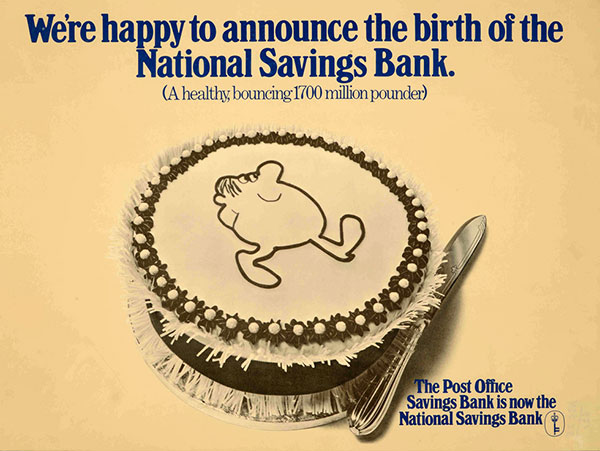

National Savings Bank Act

Parliament passes a new National Savings Bank Act. It gives legal backing to continue the Ordinary Account and Investment Account as the two products offered by the National Savings Bank. Decimalisation of the national currency also changes the way in which NS&I calculates interest payments.

ERNIE 2

The second generation of ERNIE is created, decreasing the time it takes to make a draw. Designed to look like part of the set of the Bond movie, ‘Goldfinger, ERNIE 2 can generate the necessary numbers in just a few hours, compared to the 10 days it was taking ERNIE 1 to complete the draw by the end of his lifespan.

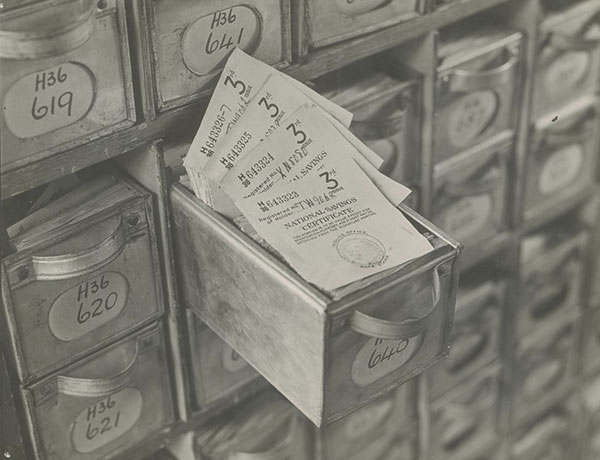

Computerisation

Technology replaces technology. Instead of holding physical stocks of certificates, a new computer system processes and holds the records of certificate purchases on its own computer files. Goodbye to the two LEO 326 machines and welcome to a new ICL System 4-72 machine. Farewell to the punch card system as the PCK (Processor Controlled Keying System) takes over.

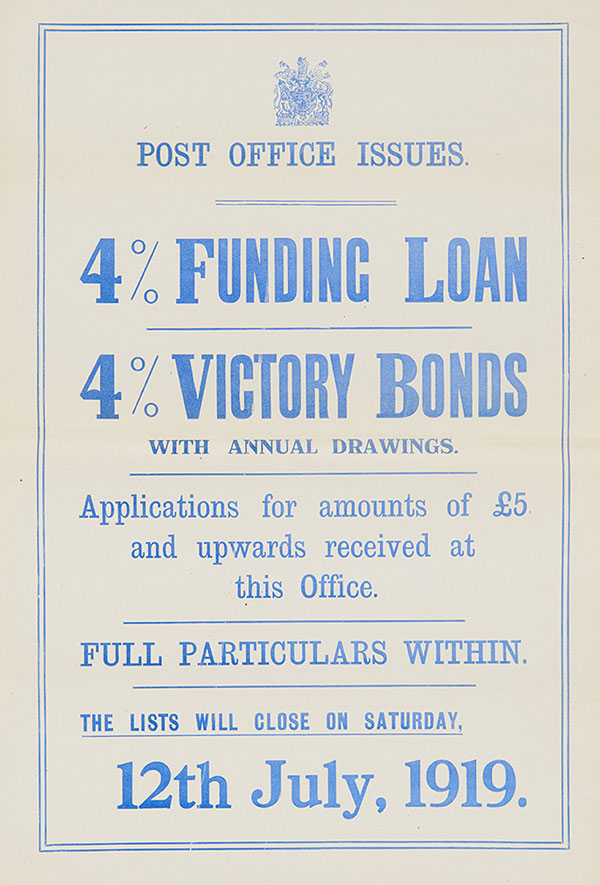

The End of 4% Victory Bonds

The final Victory Bond, opened in 1919, is redeemed.

Savings Stamps withdrawn from sale

Amid high inflation in the global economy, the once-popular Savings Stamps have to go.

Children's Bonus Bonds introduced

The first Children's Bonus Bonds goes on sale.

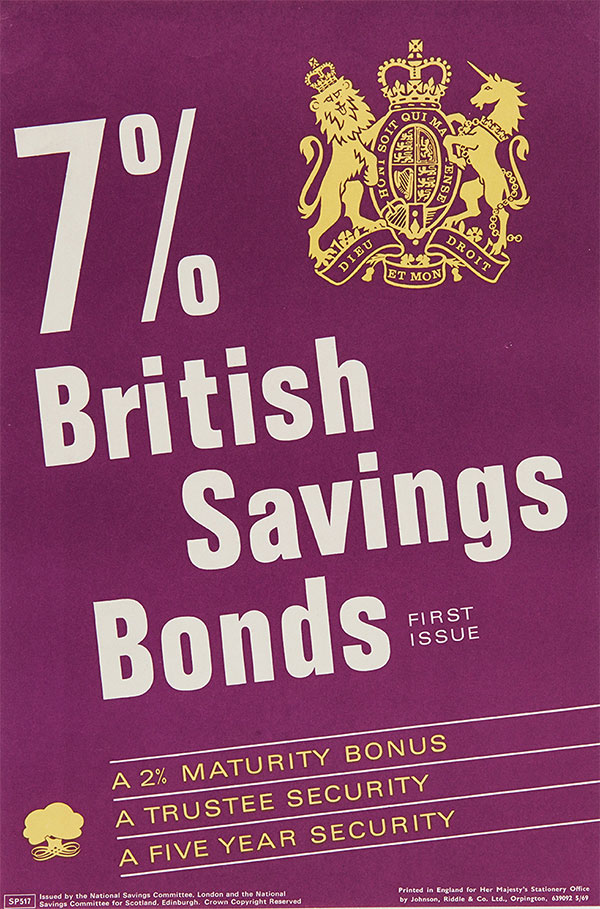

FIRST Option Bonds

First Option Bonds, one-year fixed rate bonds of 7.75%, net of basic-rate tax, went on sale. They were extremely popular, and within a year the interest rate on offer had decreased to 4.75%.

Internet Age

The Internet Age

The Computer Age is giving way to the Internet Age. The Netscape corporation introduces SSL, opening up a world where internet payments can be made online. The mp3 file format and amazon.com launch and Microsoft releases Internet Explorer 1.

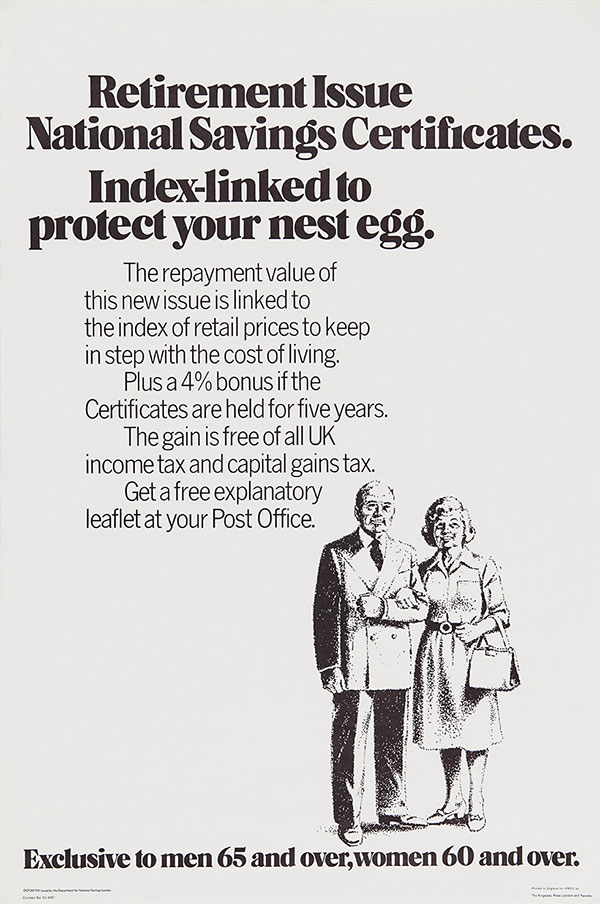

Pensioners Guaranteed Income Bonds

Now, you only need to be 60 to buy Pensioners Guaranteed Income Bonds. The maximum holding limit increases from £20,000 to £50,000.

National Savings becomes an Executive Agency

On 1 July 1996, National Savings is established as an Executive Agency of the Chancellor of the Exchequer.

Outsourcing operations

National Savings successfully outsources operations to Siemens, with thousands of Civil Servants retaining their jobs under different direct management. It is the biggest ever single move of staff contracts from the Civil Service to the private sector, delivering savings for taxpayers and more accountability on delivering against a multi-million-pound private contract.

NS&I Rebrand

'National Savings' is rebranded as 'National Savings & Investments'. A new logo contains a conker emerging from its shell, representing security and renewal. Chosen after conducting market research with customers, the word 'Investment' is included to better represent what the organisation does.

Explaining ERNIE

It is sometimes difficult to explain how we can prove ERNIE's number generation is truly random. Previous attempts used music and sound to explain random noise, but in 2015 we had some 'serious fun' with paint, amplifiers and some very, very white dust sheets. At least, they were white to begin with...

New premises for a new-look business

While NS&I continues to reduce the cost of its operations to taxpayers, new premises are required for the Durham and Blackpool offices. The demolition of ‘ERNIE Tower’ - Blackpool's second-most-famous tall building - draws a large crowd.

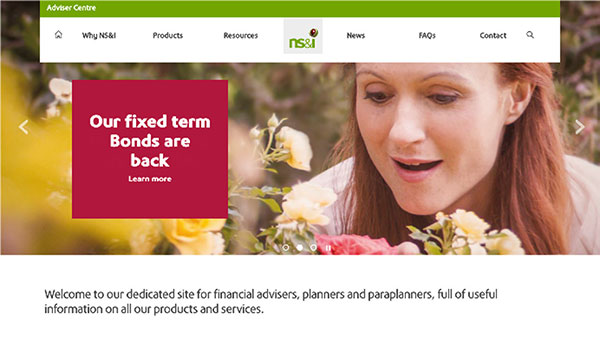

NS&I website relaunch

The nsandi.com website relaunches with a major focus on customers’ ability to transact on the site. It is now much easier for customers to see their savings and investments, make deposits and withdrawals and update their personal details.

Introducing ERNIE 5

For over 60 years, ERNIE used random thermal noise to produce numbers. But from March 2019, ERNIE 5 uses quantum technology to generate the winning numbers, completing its first draw in just 12 minutes – over 40 times faster than ERNIE 4.

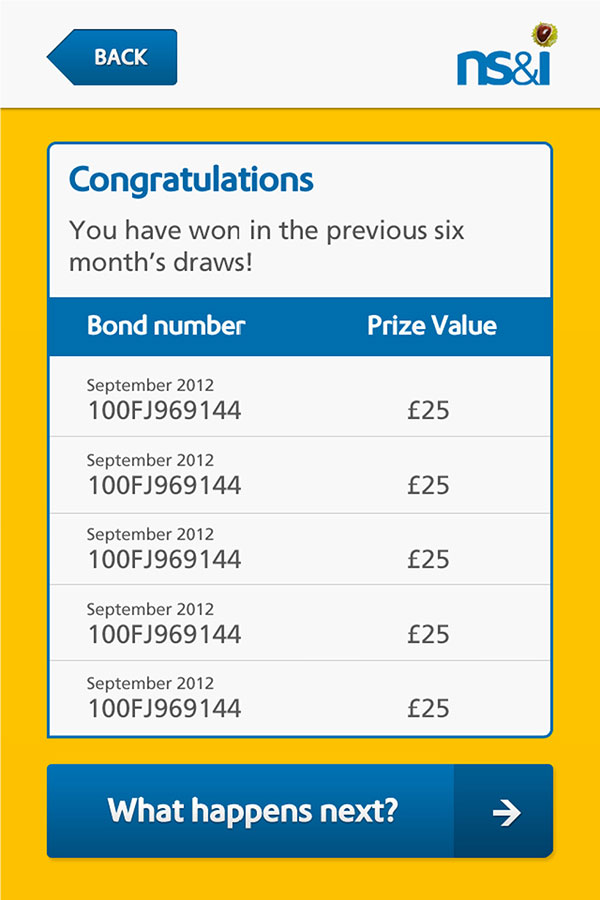

“Alexa, open Premium Bonds”

The Premium Bonds prize checker Alexa skill is a UK financial services first. Customers can check if they have won any prizes in the monthly draw or if they have any unclaimed prizes by simply speaking to their voice-activated device.

Discover the different ways to find out about your Premium Bonds prizes.