A boost for savers: NS&I increases interest rates

NS&I will pass on the Bank of England’s interest rate rise to savers, following the decision to increase the base rate from 0.25% to 0.50%.

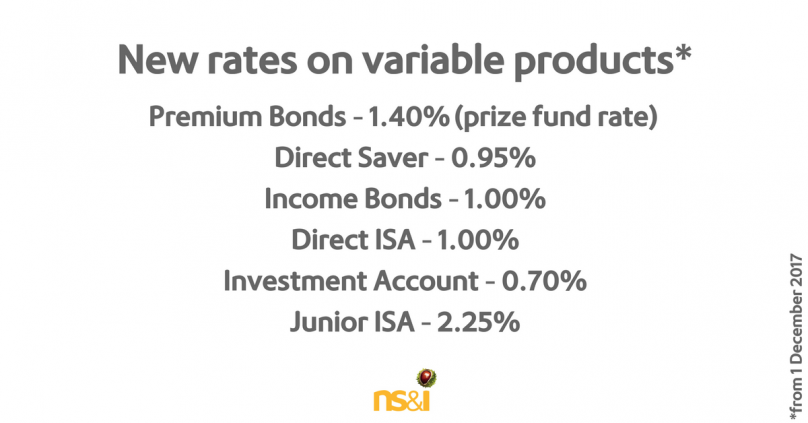

Interest rates paid on Direct ISA, Direct Saver, Income Bonds, Investment Account and Junior ISA will increase by 25 basis points from 1 December 2017. The prize fund rate on Premium Bonds will also increase by 25 basis points to 1.40% and the odds will improve from 30,000 to 1 to 24,500 to 1. The number of prizes paid out each month will increase from 2.3 million to circa 2.9 million – the highest number of prizes in any monthly Premium Bonds prize draw to date. The changes will come into effect from the December 2017 draw.

Ian Ackerley, Chief Executive, NS&I, said:

“NS&I is pleased to be able to offer savers increased rates across our variable products. By reflecting the change in the base rate we are continuing to meet the needs of savers, whilst also balancing the interests of taxpayers and the stability of the broader financial services sector.

“For our 25 million customers, including around 21 million Premium Bonds customers, these changes will present a welcome boost. NS&I will be giving out the largest number of Premium Bond prizes every month, an estimated 2.9 million, and all money invested is 100% secure, as NS&I is backed by HM Treasury.”

Variable rate savings products

| Product | Current rate | New rate (from 1 December 2017) |

|---|---|---|

| Direct ISA | 0.75% tax-free/AER | 1.00% tax-free/AER |

| Direct Saver | 0.70% gross/AER | 0.95% gross/AER |

| Income Bonds | 0.75% gross/AER | 1.00% gross/AER |

| Investment Account | 0.45% gross/AER | 0.70% gross/AER |

| Junior ISA | 2.00% tax-free/AER | 2.25% tax-free/AER |

Premium Bonds

| Current prize fund rate | Current odds | New prize fund rate (from December 2017) | Odds (from December 2017) |

|---|---|---|---|

| 1.15% | 30,000 to 1 | 1.40% | 24,500 to 1 |

| November 2017 | December 2017 (estimate) | |

|---|---|---|

| Total value of prizes | £68,308,325 | £83,071,775 |

| Total number of prizes | 2,375,944 | 2,906,305 |

| Prize band split: Higher value (£5,000+) Medium value (£500-£1,000) Lower value (£25-£100) |

5% of prize fund 5% of prize fund 90% of prize fund |

5% of prize fund 5% of prize fund 90% of prize fund |

| Value of prizes | Number of prizes in November 2017 | Number of prizes in December 2017 (estimate) |

|---|---|---|

| £1,000,000 | 2 | 2 |

| £100,000 | 3 | 4 |

| £50,000 | 5 | 9 |

| £25,000 | 12 | 18 |

| £10,000 | 28 | 42 |

| £5,000 | 57 | 87 |

| £1,000 | 1,366 | 1,660 |

| £500 | 4,098 | 4,980 |

| £100 | 22,190 | 22,792 |

| £50 | 22,190 | 22,792 |

| £25 | 2,325,993 | 2,853,919 |

| Total | 2,375,944 | 2,906,305 |

Notes to Editors

- NS&I is one of the largest savings organisations in the UK, offering a range of savings and investments to 25 million customers. All products offer 100% capital security, because NS&I is backed by HM Treasury.

- Tax-free means that the interest or prizes are exempt from UK Income Tax and Capital Gains Tax

- Gross is the taxable rate of interest without the deduction of UK Income Tax.

- AER stands for Annual Equivalent Rate and enables the comparison of interest rates from different financial institutions and across different products on a like-for-like basis. It illustrates what the annual rate of interest would be if the interest was compounded each time it was paid. Where interest is paid annually, the quoted rate and the AER are the same.

- Information on our products can be found here.

- For further information please contact the NS&I media team.