2017-18 Annual Report and Accounts: A substantial contribution to government finance

Delivering cost-effective debt financing to the Government remains NS&I’s core objective. At the March 2017 Budget, our Net Financing target for 2017–18 was set at £13 billion (in a range of £10 billion to £16 billion).

This was a higher target than in recent years, reflecting the launch of Investment Guaranteed Growth Bonds in April 2017. Announced by the Chancellor in the 2016 Autumn Statement, this market-leading 3-year savings bond was designed to support savers who have been affected by low interest rates.

At the Autumn Budget in November 2017, our Net Financing target was reduced to £8 billion (in a range of £5 billion to £11 billion). The change to the target reflected lower than expected Net Financing being delivered in the first half of 2017–18, partly as a result of these changes in the savings market.

In December, we brought back on sale two of our most popular products, Guaranteed Growth Bonds and Guaranteed Income Bonds. These had not been on sale for nine years and both were available as 1-year and 3-year bonds. As expected, both products proved popular.

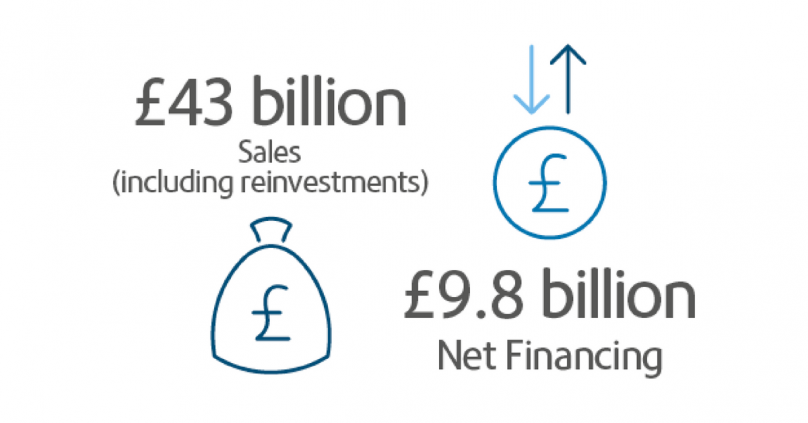

The new rates available on Guaranteed Growth Bonds and Guaranteed Income Bonds were also available to maturing 65+ Bonds and proved attractive, with nearly three-quarters of holders opting to reinvest with NS&I. Some £9 billion of 3-year 65+ Bonds matured from mid-January 2018.

Together with sales of Premium Bonds, these factors contributed to a Net Financing contribution of £9.8 billion to HM Treasury. This was within the range of our revised target. It also took the total amount invested in NS&I products to more than £150 billion for the first time. In the 2018 Spring Statement, it was confirmed that NS&I will have a 2018–19 Net Financing target of £6 billion, within a range of £3 billion to £9 billion.